A lot of our clients freak out when they get their first franchise tax notice from the state of Delaware. It usually goes something like this “You told me my franchise tax in Delaware wouldn’t be more than $1,000. I just got a bill for $51,209.59. I’m just a startup. Help!!!”

The good news is that in the vast majority of instances, your franchise tax will be well below that amount, closer to the minimum of $400 plus a $50 filing fee for your annual report. Please make sure that you login to the Delaware Division of Corporations, file your annual report and pay your annual franchise tax before March 1 of each year. Failure to do so will result in penalties and interest as well as potentially having your corporation or LLC suspended by the state.

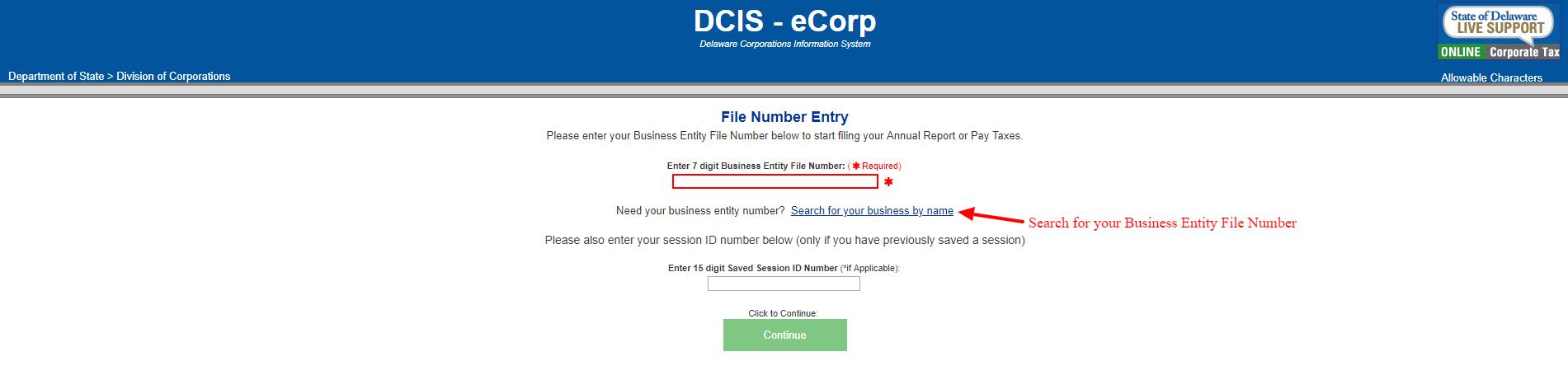

Once you login to file your annual report, you’ll be asked to enter your 7 digit Business Entity File Number. You can use the link provided on the page (directly below the red box) to lookup your entity and find this number.

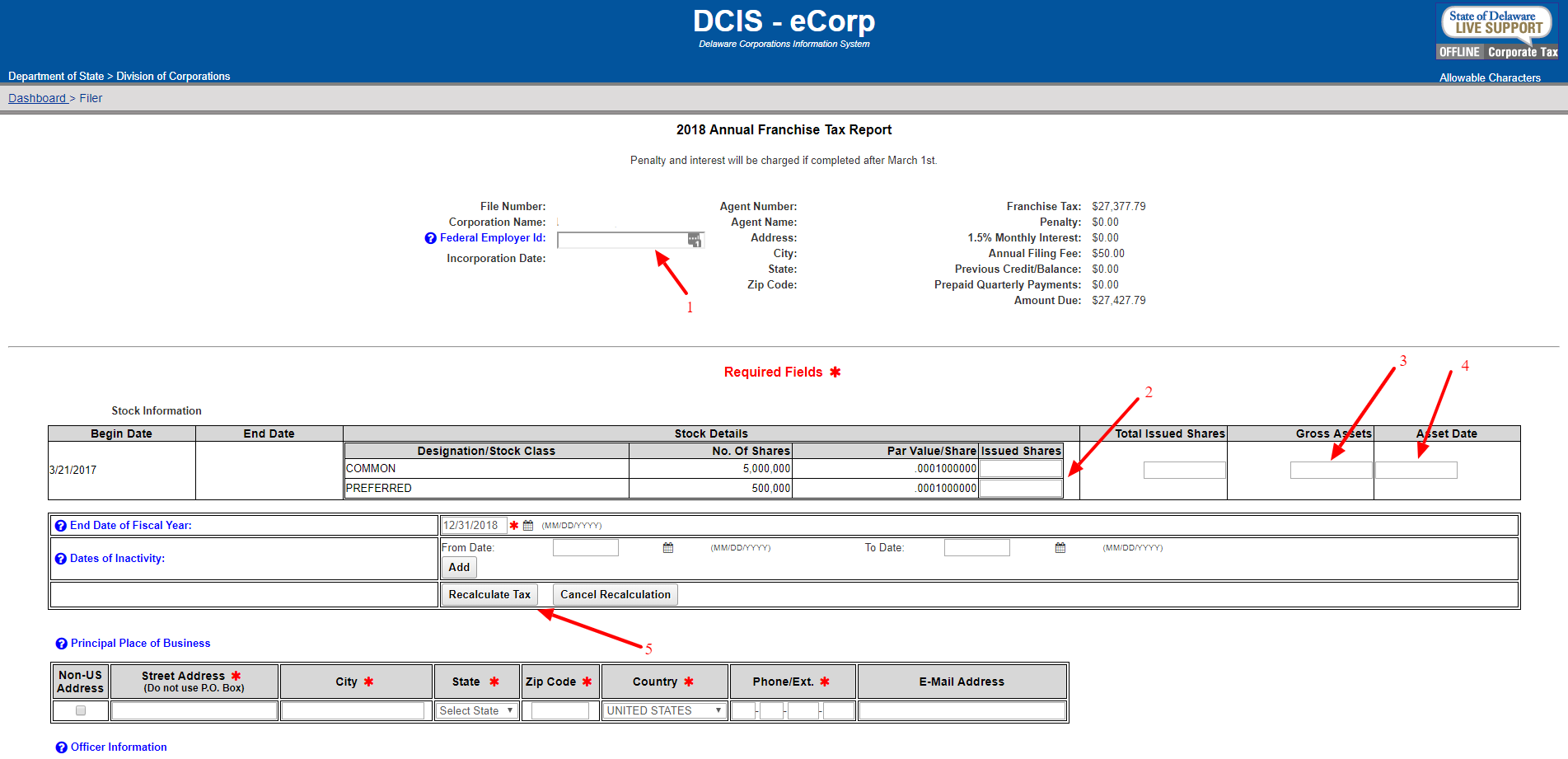

After you login to the state website, it will initially show the outrageous sum “owed” by the company. Don’t panic. By entering a few pieces of information, you will soon be able to reduce the amount you owe. Please look at the picture below and follow the steps indicated thereafter.

1. Enter the employer identification number for the entity here.

2. Enter then number of outstanding shares for each class as of the end of the year (generally December 31). Note this will almost always be a number less than (but never greater than) the number of authorized shares which is filled in automatically based on your Certificate of Incorporation.

3. This is the trickiest part. You need to enter the gross assets from IRS Form 1120, Schedule L tax form for the same year that the company is filing its annual report. If the company has not filed its taxes for that year yet, then a number from a recent balance sheet will suffice and can be amended later if necessary.

4. Fill in the date which you are using for your gross assets figure.

5. Once you’ve entered in the information above, press the “Recalculate Tax” button.

You’re now done with the hardest part of the filing. Now you need to completely fill in the remaining information requested (address of the company, name of an officer and name of all directors). Most companies just list their corporate address for everyone including independent board members who have a business address of their own.

Once you’ve completed the above, you can either save your work or continue to pay your franchise tax and file your annual report. You should download the final version, save a copy and email a copy to your lawyer and accountant.